a beginner’s guide to day trading online 2nd edition

Day trading involves buying and selling financial instruments within a single trading day․ It offers potential high returns but requires strategy and discipline․ Toni Turner’s guide provides a step-by-step approach for beginners to understand markets, tools, and risk management, helping them develop a trading plan and psychological resilience․

1․1 What is Day Trading?

Day trading involves buying and selling financial instruments within the same trading day, aiming to capitalize on short-term price movements․ It requires a strategic approach, as all positions are closed before the market closes․ Unlike long-term investing, day trading focuses on immediate gains, making it both profitable and risky․ Toni Turner’s guide highlights the importance of discipline and focus for success in this fast-paced environment․

1․2 Benefits and Risks of Day Trading

Day trading offers potential high returns through short-term price movements but carries significant risks, including substantial losses․ It demands discipline, strategy, and quick decision-making․ Toni Turner’s guide emphasizes the importance of understanding these aspects to navigate the volatile markets effectively and minimize risks while maximizing opportunities for profit in this challenging yet rewarding field․

Choosing the Right Online Broker

Selecting a reliable online broker is crucial for day trading success․ Look for platforms offering essential tools, competitive fees, and strong customer support․ Toni Turner recommends Interactive Brokers and Webull for beginners, ensuring access to advanced trading resources and user-friendly interfaces․

2․1 Factors to Consider When Selecting a Broker

When choosing a broker, consider reliability, trading fees, platform usability, and customer support․ Ensure the broker offers access to real-time data, charting tools, and a variety of financial instruments․ Beginners should prioritize platforms with educational resources and demo accounts to practice trading strategies without risking real capital․

2․2 Recommended Brokers for Beginners

Interactive Brokers and Webull are highly recommended for beginners due to their user-friendly platforms and low fees․ Interactive Brokers offers a robust trading environment with competitive pricing, while Webull provides a free, commission-free trading experience with real-time data and essential tools․ Both brokers cater to new traders, offering educational resources and demo accounts to practice strategies․

Essential Tools and Resources

Trading platforms, charting software, and real-time data feeds are crucial tools for day traders․ They provide the necessary insights and execution capabilities to make informed decisions․

3․1 Trading Platforms and Software

Reliable trading platforms and software are essential for executing trades efficiently․ Platforms like Interactive Brokers and Webull offer real-time data, advanced charting tools, and customizable interfaces․ These tools help traders analyze markets, identify trends, and make precise entries and exits․ Toni Turner’s guide highlights the importance of selecting the right platform to align with your trading strategy and goals, ensuring a seamless trading experience․

3․2 Charting and Analysis Tools

Charting and analysis tools are crucial for identifying trends and making informed trading decisions․ Toni Turner’s guide emphasizes the use of technical indicators like moving averages and RSI to analyze price movements․ These tools help traders spot entry and exit points, enabling them to execute trades more effectively․ They are indispensable for both beginners and experienced traders in day trading scenarios․

3․3 Real-Time Data Feeds

Real-time data feeds are essential for day traders to access current market prices and execute timely trades․ Toni Turner’s guide highlights their importance for precision entries and exits․ These tools provide up-to-the-minute information, enabling traders to react swiftly to market changes․ They are particularly valuable for active trading strategies, ensuring decisions are based on the most accurate and up-to-date data available․

Understanding the Financial Markets

Financial markets involve trading various instruments like stocks, ETFs, and E-minis․ Understanding market hours, sessions, and the impact of news is crucial for successful day trading strategies․

4․1 Overview of Financial Instruments

Financial instruments for day trading include stocks, ETFs, E-minis, options, futures, and cryptocurrencies․ Stocks represent company ownership, while ETFs track asset baskets․ E-minis are smaller futures contracts, and options provide the right to buy or sell assets at set prices․ Futures involve contracts to trade at future dates, and cryptocurrencies like Bitcoin offer high volatility, making them popular for short-term trading strategies due to liquidity and leverage opportunities․

4․2 Market Hours and Sessions

Market hours vary by financial instrument and exchange․ Stocks trade during specific sessions, such as the New York Stock Exchange (9:30 AM–4:00 PM ET)․ Global markets like London and Tokyo operate on different schedules, affecting trading opportunities․ Understanding these hours is crucial for timing entries and exits effectively, especially in day trading where liquidity and volatility fluctuate significantly during active sessions․

4․3 Impact of News and Events

News and events significantly influence market movements, creating opportunities and risks for day traders․ Economic reports, earnings announcements, and geopolitical events can cause rapid price swings․ Staying informed about market-moving news and incorporating it into your trading plan is essential․ Tools like news calendars and real-time alerts help traders anticipate and react to potential market shifts effectively․

Developing a Trading Plan

A well-structured trading plan is essential for success․ It outlines goals, entry/exit strategies, and risk management․ Toni Turner’s guide emphasizes setting clear objectives and sticking to disciplined strategies, helping traders avoid impulsive decisions and build consistent profitability over time․

5․1 Setting Trading Goals

Setting clear trading goals is crucial for success․ Define your objectives, risk tolerance, and time commitment․ Align goals with market conditions and analysis․ Toni Turner’s guide emphasizes the importance of realistic expectations and discipline in achieving consistency․ Establishing a roadmap helps traders stay focused and avoid impulsive decisions, fostering a disciplined and profitable approach to day trading․

5․2 Identifying Entry and Exit Points

Identifying entry and exit points requires a combination of technical analysis and market intuition․ Use indicators like moving averages, RSI, and chart patterns to pinpoint potential trades․ Set clear criteria for entering and exiting positions to minimize risks․ Toni Turner’s guide highlights the importance of precision and discipline in executing trades, ensuring consistency and profitability in day trading strategies․

5․3 Risk Management Strategies

Risk management is crucial for day trading success․ Use stop-loss orders to limit losses and position sizing to control exposure․ Diversify trades across assets to reduce risk․ Set daily loss limits and avoid over-leveraging․ Toni Turner’s guide emphasizes discipline in adhering to risk parameters, ensuring long-term profitability and protecting capital from significant drawdowns․ Regular portfolio reviews and strategy adjustments are essential for sustained success․

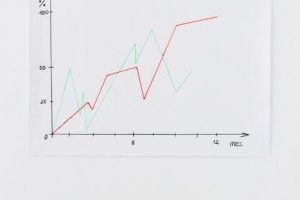

Technical Analysis Basics

Technical analysis uses charts and indicators to predict price movements․ It helps identify trends, support/resistance levels, and potential entry/exit points․ Toni Turner’s guide explains how to apply these tools effectively for informed trading decisions․

6․1 Key Indicators for Day Trading

Key indicators like moving averages, RSI, and MACD are essential for day trading․ These tools help identify trends, overbought/oversold conditions, and potential price reversals․ Toni Turner’s guide explains how to use these indicators effectively to make informed decisions and enhance trading strategies․

6․2 Common Chart Patterns

Common chart patterns like triangles, wedges, and head-and-shoulders formations help traders predict price movements․ Toni Turner’s guide explains how to identify these patterns, such as E-minis and ETFs, to time entries and exits effectively․ These visual tools enable traders to anticipate potential breakouts or reversals, enhancing their ability to make informed, strategic decisions in fast-paced markets․

Trading Psychology and Discipline

Day trading demands overcoming fear and greed, staying disciplined, and adhering to your trading plan․ Toni Turner emphasizes the importance of mental resilience and emotional control․

7;1 Overcoming Fear and Greed

Overcoming fear and greed is crucial for successful day trading․ Fear can prevent traders from executing profitable trades, while greed may lead to overtrading․ Toni Turner’s guide emphasizes the importance of developing a disciplined mindset, setting clear goals, and using risk management strategies to maintain emotional balance․ Journaling trades helps identify emotional patterns and improve decision-making, fostering resilience and focus․

7․2 Importance of Discipline

Discipline is the cornerstone of successful day trading, helping traders stick to their plans and avoid impulsive decisions․ Toni Turner’s guide highlights how discipline fosters consistency, risk management, and long-term profitability․ Without it, emotions like fear and greed can derail even the best strategies, emphasizing the need for self-control and adherence to proven trading practices․

7․3 Keeping a Trading Journal

A trading journal is an essential tool for documenting each trade, helping traders analyze their strategies and identify areas for improvement․ By recording every trade’s details and outcomes, traders can learn from their mistakes, enhance their decision-making, and develop emotional resilience․ Consistently maintaining a journal fosters accountability and clarity, crucial for continuous growth and achieving long-term success in day trading․

Next Steps and Continuous Learning

Start small, practice strategies, and commit to ongoing education․ Continuous learning ensures adaptability to market changes, refining skills for long-term success in day trading․

8․1 Starting Small and Practicing

Beginners should start with small trades to minimize risk while gaining experience․ Practice with paper trading or small positions to refine strategies․ Focus on understanding market dynamics and building confidence gradually․ Toni Turner emphasizes the importance of precision entries and exits, as well as adapting to new trading products like ETFs․ Consistent practice helps develop discipline and improves decision-making skills over time․

8․2 Importance of Ongoing Education

Ongoing education is crucial for day traders to stay updated on market trends and strategies․ Toni Turner’s guide emphasizes the importance of continuous learning to adapt to evolving markets․ Staying informed about new trading tools, products, and techniques ensures long-term success․ Regularly reviewing and updating trading knowledge helps traders remain competitive and resilient in dynamic financial environments․